Energy Project Bankability Assessment

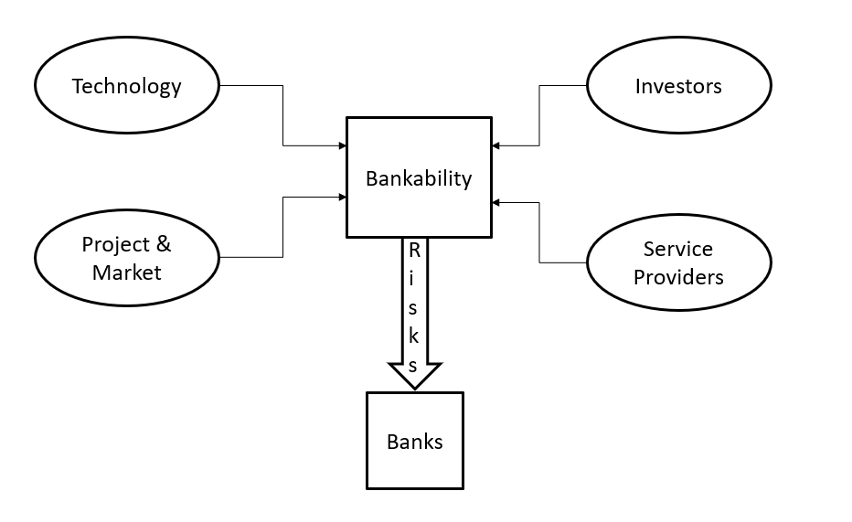

Because of the risks involved in financing energy projects, financial institutions and developers depend on qualified third-party assessment of project risks – from inception and operation to covering the life of the projects. Each financed project has its own attributes governing its technical, legal, and economic objectives.

Quanta Technology’s experts, advisors, and analysts are fully immersed in the technical, legal, and economic risks of the energy industry. We are aware of possible ways to measure and mitigate (to the extent possible) identified risks. We are also aware of these diverse risks from the project developer side as well as from potential investors and debt providers sides.

Service Offerings

Independent Engineering Review and Assessment

- Project site due diligence

- Site visit and layout

- Permits and environmental issues

- Site control and access

- Civil and geotechnical investigation

- Project design due diligence

- Project configuration and technology

- Electrical and balance of plant (BOP)

- SCADA, metering, communication, and monitoring

- Protection and regulatory compliance

- Energy production due diligence

- Energy forecast

- Energy losses, degradation, and efficiency

- Reliability and maintenance schedules

- Equipment replacement and end of life (EOL)

Contracts Reviews and Assessment

- Equipment supply

- Insurance, liabilities, and warranties

- Defect liability period

- EPC contract

- Liquidation damages and performance

- Testing and on-site spare equipment

- PPA/off-take agreement

- Electrical interconnection

- O&M and asset management

Financial Assessment

- CAPEX and OPEX

- Pre-development and construction “year 0” costs

- Taxes and deferrals/abatements

- Equity vs. debt

- Revenue: market (merchant) vs. off-take (PPA)

- Credit worthiness (off-taker)

- Federal/State/Local funding/grants

- Annual escalation and development fees

- ROI (levered/unlevered)

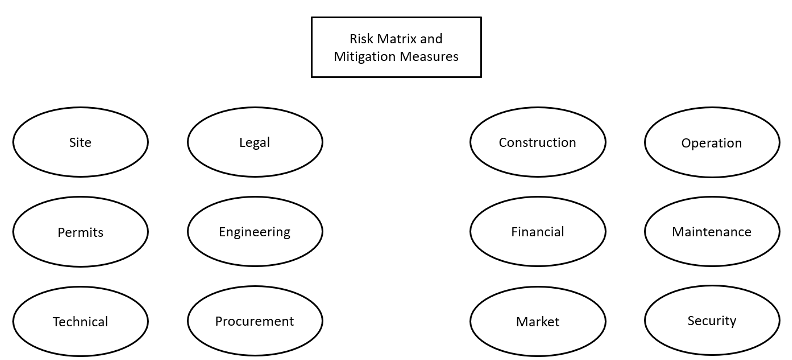

Risk Assessment

- Technical

- Project

- Economic

- Legal

- Regulatory

Bankability Objectives

- All risks are properly identified

- Risks are indexed and/or costed/priced in a matrix

- No unidentified risks remain

- Investors have committed equity

- Banks/financial institutions to fund debt

Why Quanta Technology?

We understand the overall risks involved when a diverse group of energy stakeholders must take a project from the greenfield development stage into inception and beyond. Quanta Technology’s technical, financial, practical, and economic expertise to provide robust and reliable project bankability assessments is unparalleled. Our Transmission & Regulatory group has been fully engaged in energy project development and project financing on individual projects and project portfolios. This experience provides the group with a solid foundation for proper and defendable bankability reviews, assessments, and recommendations (based on inputs from a wide range of experiences). The group utilizes many tools for its in-house assessment including market pricing forecast software and its proprietary financial pro-forma model.

Bankability Projects

➢ 1,200MW NGCC plant – Peoples Gas

➢ 600MW NGCC plant – ABN AMRO

➢ 450MW NGCC plant – TD Securities

➢ Asset acquisition closing – BECo and GPU

➢ Asset acquisition closing – PSEG

➢ Electrical distribution company acquisition – South America

➢ Solar plant acquisition closing – New Mexico